12 Apr

The field of poison centre notifications – PCN is quite complicated with many options, exceptions and edge cases. It often happens that doubts arise as to who is obliged to generate UFI codes, make PCN submissions and add UFI codes to the product.

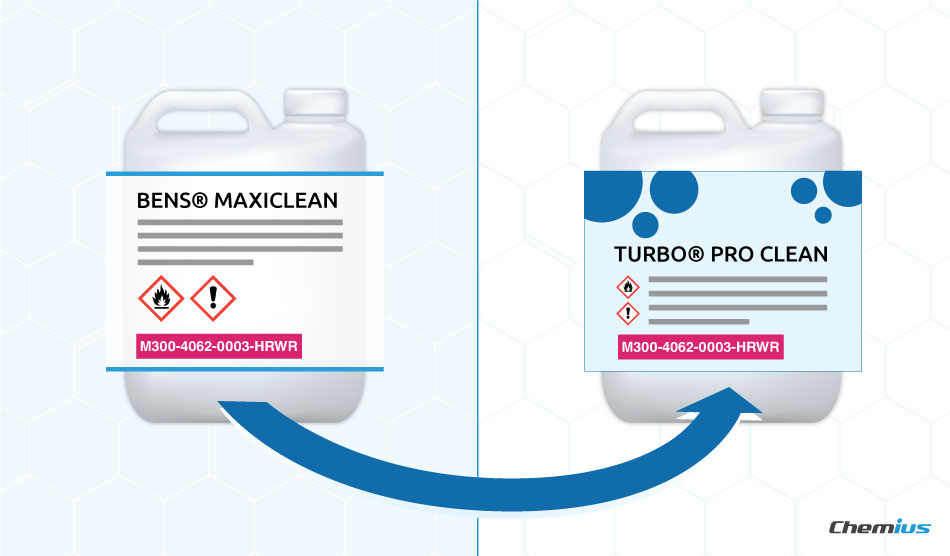

Let’s look at an example. The company produces a product for a foreign trademark. In this case, it performs the function of a toll formulator. In the case of a foreign trademark, all product rights related to the intellectual property of that trademark are held by the owner who registered that trademark, and not the manufacturer of the product, as you might think.

What does such an example mean for PCN notifications? More specifically, what about PCN submission and UFI code in such a case? In other words, whose duty is it to generate the UFI code and arrange the PCN submission for such a product?

Luckily, the Guidance for Annex VIII to the CLP Regulation foresees such a case and the obligations are clearly defined.

The guidance dictate that the manufacturer of a foreign trademark product is the one who bears the obligations to generate a UFI code, make the PCN submission and has to add the UFI code to the product.

We must mention the problem that arises most often.

By decrypting the UFI code, it is possible to obtain information about the VAT number of the product manufacturer of a foreign brand. Of course, companies (the brand owner) often do not want to disclose this information.

Fortunately, there are several alternative approaches regarding UFI code generation. Let’s look at three such ways:

- The trademark owner can generate UFI codes with their own VAT number, provide them to the manufacturer and ask the manufacturer to include them in their PCN submission.

- The trademark owner can generate UFI codes with their own VAT number and include them in a PCN submission. In doing so, it is possible to refer and link to the submission from the manufacturer, if it has already been made.

- The trademark owner can generate UFI codes with their own VAT number and include them in a PCN submission, without referring to the application made by the manufacturer. This can only be done if all the necessary data for the PCN submission are available.

The guidance also states that in such cases it is good to sign a contractual agreement, where all the obligations and duties of the companies related to the PCN submissions are clearly defined.

If you are asking yourself similar questions or need any other help regarding PCN submissions, you can contact me at tim.bencik@bens-consulting.eu.

Tim Bencik